Agora is a system adapted to Veri*factu version 8.2.5 and complies with the provisions of the law and the requirements described.

GET READY TO VERI*FACTU WITH AGORA

Do you know what the Verifactu system is and how it will impact your business invoicing? We explain everything you need to know to comply with this new regulation, how it is integrated in the Agora software and when you should activate it so that your business is ready.

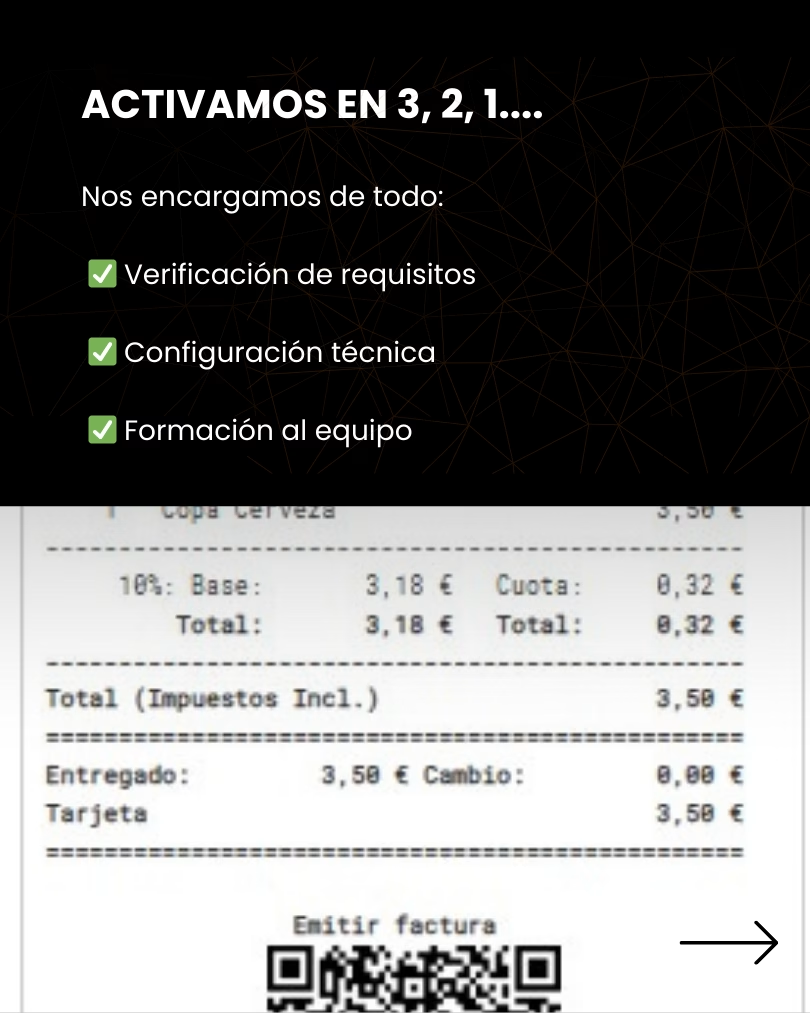

Do you want to activate the Veri*factu system?

We are already providing our customers with a secure and 100% implementation adapted to the new regulations. See how to activate Verifactu in 3 simple steps

SIX KEYS TO VERIFACTU

Did you know that?

If a company continues to use non-compliant software that is no longer maintained, the responsibility lies solely with the user company.

The manufacturer and/or distributor is not liable if the software was purchased before the entry into force of the regulation and the customer decides not to update it.

Source: Art. 201 bis of Law 58/2003 (LGT) and Fourth Additional Provision of RD 1007/2023.

Who is affected and Sanctions

If you issue invoices, whether full invoices or simplified invoices (such as tickets), you must comply with the regulations. The General Tax Law provides for penalties of up to €50,000.

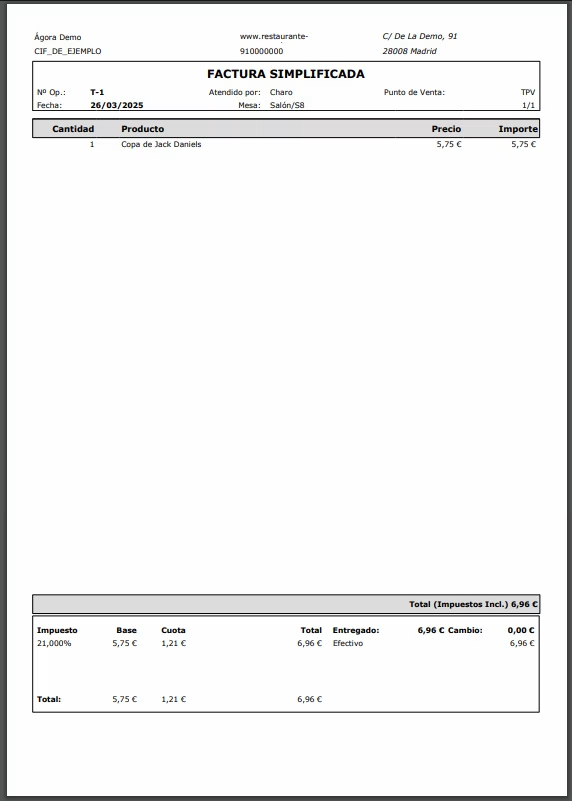

Elements to be present in the New Invoice

Find out which elements must be present in the new Veri*factu invoice to avoid problems.

Keys and benefits of the new regulation

We present you the Veri*factu guide to know the details of its implementation.

Need more information? Check our FAQ

What is VERI*FACTU?

VERI*FACTU is the name commonly given to the Royal Decree 1007/2023which regulates the requirements to be met by invoicing software used by businesses and professionals.

This regulation, derived from the Anti-Fraud Law, requires computerised invoicing systems (ICS) to ensure that the integrity, traceability and security of invoices issued, in order to make tax fraud more difficult.

The main obligations include that the system:

-

Generate a billing record with each invoice, including security measures such as fingerprinting, linking to the previous record and, in some cases, electronic signature.

-

Add a QR code on each invoice to facilitate verification.

-

In the VERI*FACTU mode, automatically send to the tax authorities that billing record at the time of issuing the invoice.

Source: sede.agenciatributaria.gob.es

Why is it important to adapt to the VERI*FACTU regulation?

Using invoicing systems that comply with the new regulation helps to preventing fraudThis prevents the manipulation or deletion of invoices once they have been issued. This has three key benefits:

-

Greater tax justice: Fraud is reduced and the tax system is strengthened for the benefit of society as a whole.

-

Fairer competitionThe advantage of those who do not comply is limited, protecting companies that act legally.

-

Digitalisation and efficiencyThe processes are modernised, the invoice format is standardised and the exchange of information between companies, advisors and the Tax Agency is facilitated.

In addition, invoices shall include a QR code which will allow customers to easily verify its validity and, if they wish, to send certain data to the tax authorities. This improves the transparency and reinforces the culture of

What sanctions does the "tax law" provide for in relation to non-compliant programmes?

The Ley General Tributaria (General Tax Law) provides for penalties of up to €50,000 for each financial year the possession of computer systems that do not comply with the provisions of article 29.2.j) of the LGT, when they are not duly certified and must be certified by regulatory provision or when the certified devices have been altered or modified.

SourceArticle 201 bis of Law 58/2003 of 17 December 2003 on General Taxation (amended by Law 11/2021 on measures to prevent and combat tax fraud).

Can pro forma invoices, orders or delivery notes still be issued?

Yes, pro forma invoices, purchase orders or delivery notes are still allowed.. They may be used for review or approval prior to issuing the final invoice, but must not bear the tax QR code or be considered as official invoices.

Once the final invoice has been issued (with its QR and billing record generated), can no longer be modifiedunless rectified by re-registration, as required by the regulations.

The system that generates proformas must be linked to the official invoicing system, and keep a record of drafts for internal control.

Source:

-

Art. 1.1 and 1.2 of Royal Decree 1007/2023 (Regulation on invoicing systems requirements - RRSIF).

-

Art. 6.5 and 7.5 of Royal Decree 1619/2012 (Invoicing Obligations Regulation - ROF), amended by RD 1007/2023.

Are companies in the Basque Country obliged to comply with the VERI*FACTU regulation?

No. Companies and professionals subject to foral regulations (such as those in the Basque Country) are not obliged to apply the VERI*FACTU regulation approved by Royal Decree 1007/2023.

In these territories (Guipúzcoa, Vizcaya and Álava), the following already apply the TicketBAI systemwhich fulfils a similar function.

If a company in the common territory (rest of Spain) invoices another company in the Basque Country, each one must comply with its own tax regulations..

SourceArticle 1.3 of Royal Decree 1007/2023 of 5 December.

Is the SII and the VERI*FACTU regulation the same, and do I have to comply with both?

No, are distinct and mutually exclusive regulations.

-

The SII (Immediate Supply of Information) obliges VAT bookkeeping by sending electronically to the tax authorities detailed information on all invoices issued and received within very specific deadlines.

-

The regulation VERI*FACTU requires invoicing systems to generate secure records only of invoices issued, with control measures, and sending them to the tax authorities is optional.

⚠️ If you are already obliged to SII, you are not obliged to comply with VERI*FACTU. with respect to your own invoices.

What happens if an incident occurs that could lead to data loss?

Yes. Agora is designed to be a compliant Computerised Invoicing System (ICS). with the VERI*FACTU regulation and its technical order. This means that, in the event of incidents such as system crashes, network outages or internal errors, the software incorporates recovery and control mechanisms to ensure that:

-

Don't miss out on relevant billing information.

-

The integrity and inalterability of the registers.

-

Billing records can be correctly generated and retained after service is restored.

In short, Agora includes measures and procedures to remain compliant even in the event of technical failures..

Is it possible to change some of the details of an invoice without breaching the regulations?

No. Once a billing record has been generated, it cannot be changed.It is protected by measures such as fingerprinting, signing and chaining.

If corrections are needed, must be done by re-registrationThe procedures laid down in the regulations shall be followed.

In addition, it is mandatory to ensure the conservation, integrity and accessibility of all registrations for the statutory period.

Source: sede.agenciatributaria.gob.es

What happens if billing records are lost?

If you use a system VERI*FACTUas the one implemented by Agora, the records are sent to the Tax Agency and could be recovered from there in case of loss.

However, in systems of unverifiable invoicingThe responsibility for keeping records rests solely with the company, which implies more risk.

👉 For this reason, at Ágora we do not implement unverifiable invoicing systems.This ensures greater safety and regulatory compliance.

Is Agora a Verifactu Certified Software?

DECLARATION OF RESPONSIBILITY FOR THE COMPUTERISED INVOICING SYSTEM

Responsible Declaration

DECLARATION OF RESPONSIBILITY FOR THE COMPUTERISED BILLING SYSTEM OF IGT MICROELECTRONICS, S.L. FOR THE PURPOSES OF ORDER HAC/1177/2024

IGT MICROELECTRONICS, S.L. ("IGT"), with Tax Identification Code B-78032034, with address for notification purposes at Calle Alonso Cano, Nº 87 -CP 28003- Madrid, hereby and for the purposes provided for in art. 15 et seq. of Order HAC/1177/2024, of 17 October, which develops the technical, functional and content specifications referred to in the Regulation establishing the requirements to be adopted by the computer or electronic systems and programmes that support the invoicing processes of entrepreneurs and professionals, and the standardisation of invoicing record formats, approved by Royal Decree 1007/2023, of 5 December; and in the Regulation regulating invoicing obligations, approved by Royal Decree 1619/2012, of 30 November (the "Order"), DECLARES:

FIRST

That IGT is the owner of the computer system Agora, with identifier code "AG" in accordance with the specifications given in section 2.6 of the Annex to the Order, with version 8.2.5, has the following hardware and software components:

For hardware components, the system has one or more POS hardware and/or a central server, depending on the configuration of the IT system.

For software components, the system has the Agora programme.

SECOND

That the said computer system is a Point of Sale Terminal management software for businesses with the main functionalities:

Centralised system for managing multiple installations in a single database.

Business analysis with web and mobile application.

Commander with mobile application to prepare orders, manage collections and communication with the kitchen.

Kitchen monitor to manage orders and preparations in the kitchen or preparation area.

Online booking manager to be able to book a table from different communication channels.

Digital menu to be able to access the offer of the premises remotely.

Integration with delivery platforms.

Audit to query operations within the system.

Warehouse application to manage goods receipt, inventories and stock regulations.

Time control for clocking in and clocking out.

Integrations with other applications on the market.

System for making payments via QR.

Creation of invoices from the mobile by means of QR printed on the ticket.

THIRD

That this system can only operate exclusively as "VERIFACTU", in accordance with the specifications given in paragraph 2.6 of the Annex to Order HAC/1177/2024.

FOURTH

That this computer system can be used by several taxpayers, supporting the invoicing of several taxpayers. This option is only available in the centralised system.

FIFTH

That Agora, for version 8.2.5, complies with the provisions of Article 29.2.j of Law 58/2003, of 17 December, on General Taxation, in the Regulation that establishes the requirements to be adopted by computer or electronic systems and programmes that support the invoicing processes of entrepreneurs and professionals, and the standardisation of invoicing record formats, approved by Royal Decree 1007/2023, of 5 December, in this order and in the electronic headquarters of the State Tax Administration Agency for everything that completes the specifications of this order.

Madrid, Spain, 14/05/2025.

IGT MICROELECTRONICS, S.L.